Curve DAO Token (CRV) Price

Here you can see the current Curve DAO Token (CRV) price and its historical price. Curve DAO Token (CRV) is one of the cryptocurrencies you can trade on BISON.

-

Bitcoin (BTC)

...Show chart -

Litecoin (LTC)

...Show chart -

Ethereum (ETH)

...Show chart -

Ripple (XRP)

...Show chart -

Bitcoin Cash (BCH)

...Show chart -

Chainlink (LINK)

...Show chart -

Uniswap (UNI)

...Show chart -

Solana (SOL)

...Show chart -

Cardano (ADA)

...Show chart -

Polkadot (DOT)

...Show chart -

Dogecoin (DOGE)

...Show chart -

Shiba Inu (SHIB)

...Show chart -

Algorand (ALGO)

...Show chart -

The Sandbox (SAND)

...Show chart -

Decentraland (MANA)

...Show chart -

Aave (AAVE)

...Show chart -

Polygon (MATIC)

...Show chart -

Stellar Lumens (XLM)

...Show chart -

Tezos (XTZ)

...Show chart -

Ethereum Classic (ETC)

...Show chart -

Chiliz (CHZ)

...Show chart -

Axie Infinity Shards (AXS)

...Show chart -

Enjin Coin (ENJ)

...Show chart -

Basic Attention Token (BAT)

...Show chart -

Curve DAO Token (CRV)

...Show chart -

The Graph (GRT)

...Show chart -

Quant (QNT)

...Show chart

Trading platforms such as BISON or BSDEX are centralized trading places, with BSDEX even being called a centralized exchange. Centralized financial institutions are abbreviated as CeFi, including entities like ING, Sparkasse, Trade Republic, or J.P. Morgan, all of which are centralized. Decentralized financial institutions are abbreviated as DeFi, with Uniswap being probably the most famous DeFi trading place. A competitor of Uniswap is Curve. We will explore what makes Curve unique and how it differs from other DeFi trading platforms.

Inhaltsverzeichnis

What is Curve?

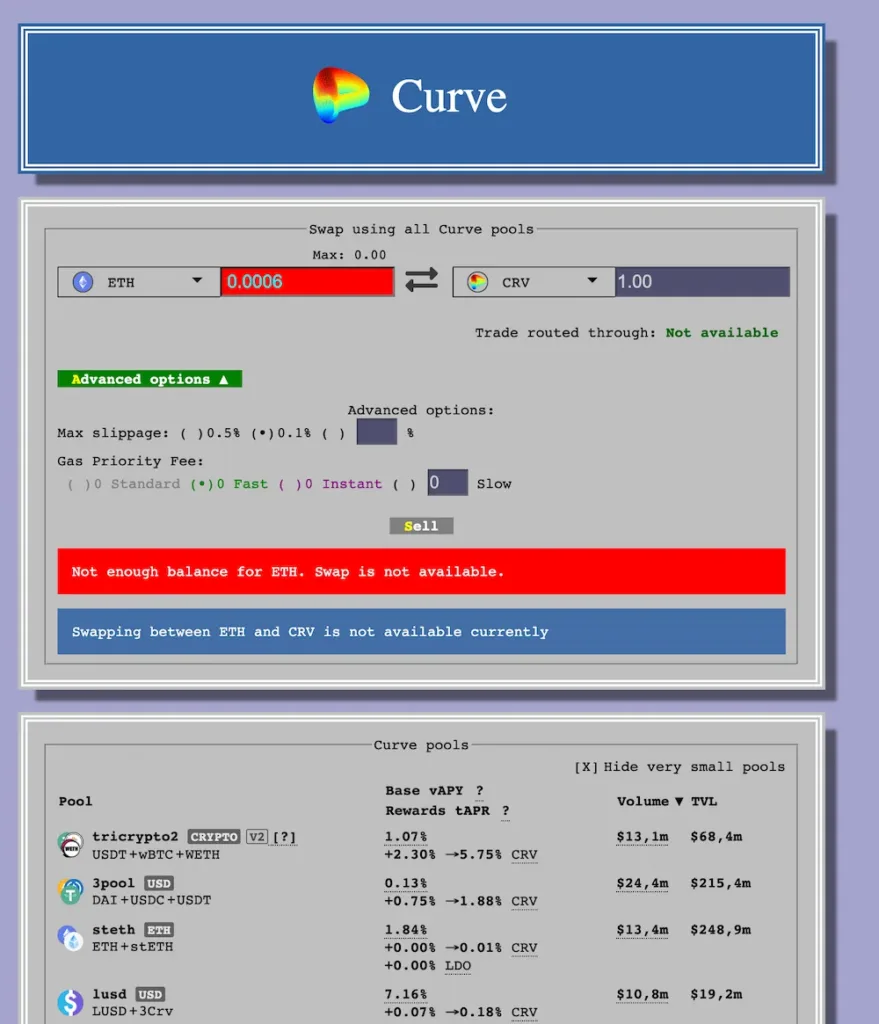

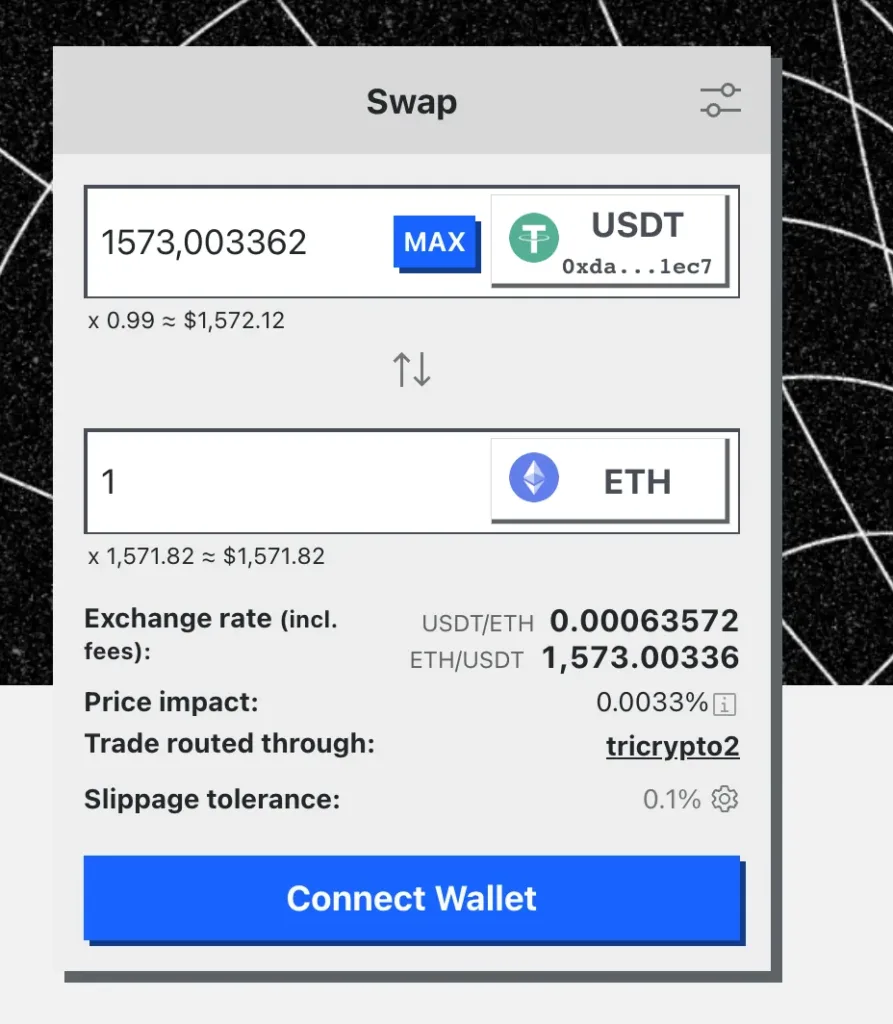

Simply put, Curve is a cryptocurrency exchange where you can swap cryptocurrencies, but not fiat money like euros or US dollars. More specifically, Curve is a decentralized trading platform focused on the trade of stablecoins. Curve’s goal is to enable low-risk and economical trading of stablecoins. However, Curve also allows trading other cryptocurrencies, as long as they are part of the Ethereum network (ERC-20 tokens).

Unlike BISON, where you exchange euros (fiat money) for cryptocurrencies (Bitcoin, Ethereum), with Curve, you trade cryptocurrency for cryptocurrency. While with BISON, you deposit money and purchased cryptocurrencies are stored by BISON, with Curve, you need to already own cryptocurrency and have your own wallet. Curve only handles the exchange, not the storage of cryptocurrency. It’s similar to a currency exchange where you exchange euros for US dollars. For this, you need to withdraw cash from your bank, go to the exchange, and receive the new currency, which you then keep in your wallet. For example, you can use MetaMask as a wallet with Curve.

If you want to try it yourself, you can simply go to https://curve.fi/, connect it with your MetaMask Wallet, and perform an exchange.

How does Curve, the decentralized cryptocurrency exchange, work?

Let’s start with the structure of a traditional exchange (be it stock or crypto). An exchange initially has buyers and sellers. Buyer A wants to buy 1 Apple share and faces 5 sellers. Buyer A accepts the cheapest offer. However, there might be instances where Buyer A wants to buy 10 Apple shares, but no sellers are available. This scenario would be unfavorable for a traditional exchange, as it would miss out on a trade and therefore revenue.

To ensure constant liquidity, there are entities known as market makers. These are financial institutions that hold large quantities of stocks/cryptocurrencies/ETFs/etc., and provide them on the exchange. They also place buy orders, ensuring sellers always find a trading partner. Market makers naturally aim to make a profit and only trade when it is profitable. They are proactive in deciding when to provide liquidity, considering factors like current market risk.

With Curve, there is no direct exchange between buyer and seller. Trades are made with an Automated Market Maker. This means the market maker is fully automated. But how does this work? A traditional market maker, also known as a Liquidity Provider, provides the capital themselves, which can be millions of euros. An Automated Market Maker does not have its own money. The money – in this case, cryptocurrencies – is provided by the community. In return, the community receives a portion of the fee.

The objective of this approach is to ensure that a) liquidity is always available, even in phases not ideal for a market maker, and b) the costs and spread are as low as possible. According to Curve, the fee is 0.04%. As reported by Trending Topics, there were around 1.7 billion US dollars in the liquidity pool in August 2023. Uniswap had a “Total Value Locked” value of 3.8 billion US dollars.

More information can be found in the six-page Stable-Swap Whitepaper and the five-page Crypto-Pools Whitepaper. Additionally, Chainlink has an extensive article on the different functions of Automated Market Makers, which is a great resource if you want to delve deeper into the topic.